Enhanced historic credit partners

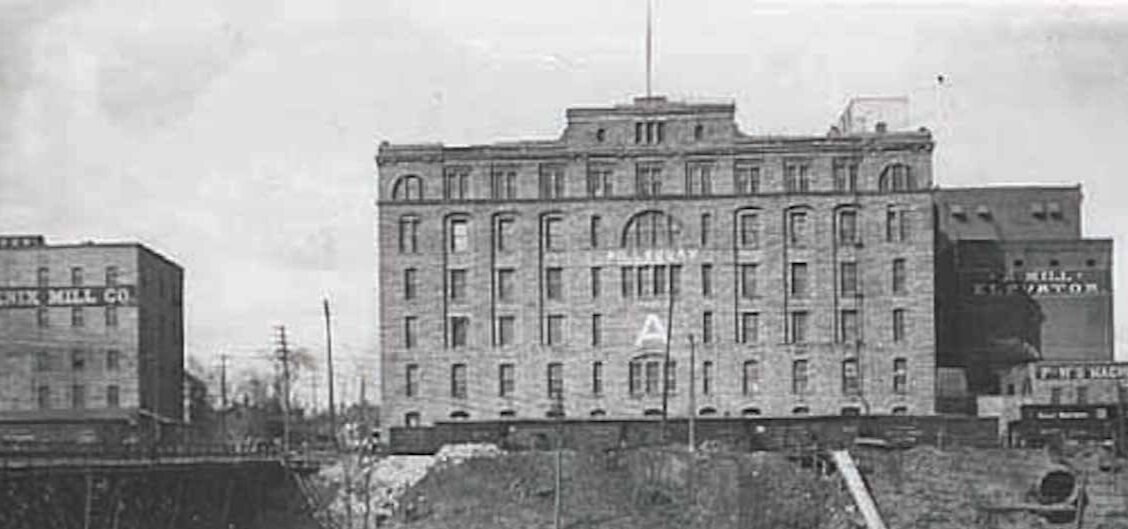

Embrace The Future. Remember The Past.

state historic investors

Why Ehcp?

Experience Matters.

With over 22 years’ experience, EHCP is an established investor in real estate projects utilizing State Historic Tax Credits (SHTC). Since 2002, we have worked with developers to address their specific project needs resulting in $700M of equity investments in 275 projects.

By focusing on the needs of the developer and project, we have forged long-lasting relationships with developers often investing in multiple projects with the same developer.

Over the past 22 years, we have developed strong working relationships with lenders, federal investors, accountants, attorneys, and supporters of both SHTC and Federal Historic Tax Credits (FHTC).

We have closed many projects that include FHTC, Tax Increment Financing (TIF), Low Income Housing Tax Credits (LIHTC), Brownfield (Greyfield), New Market Tax Credits (NMTC), Grants, and Property Assessed Clean Energy Financing (PACE) financing.

Our portfolio allows us to evolve and adapt to the ever-changing Historic Tax Credit landscape.

the numbers

Our numbers speak for themselves

From our Partners

‘Over the last nine years I have closed on over $200 million in development deals with Enhanced which spanned 7 different transactions —

From start to finish, the team at Enhanced is responsive and easy to deal with. They are truly a partner that I value as an owner and developer which is why I keep reaching back out for each new deal. In the development world where things are constantly changing and new challenges develop every day, it is reassuring to know I have a partner in Enhanced that I can count on to help get the project closed.’

– Bryce T. Henderson - Owner, Fitch Development